The shift in focus at the Fund Forum in Monaco last month was striking. At previous meetings, audiences of European asset and wealth managers heard panels highlighting ESG investing and emerging markets. But in 2024, these once fashionable topics have been replaced by geopolitics and artificial intelligence.

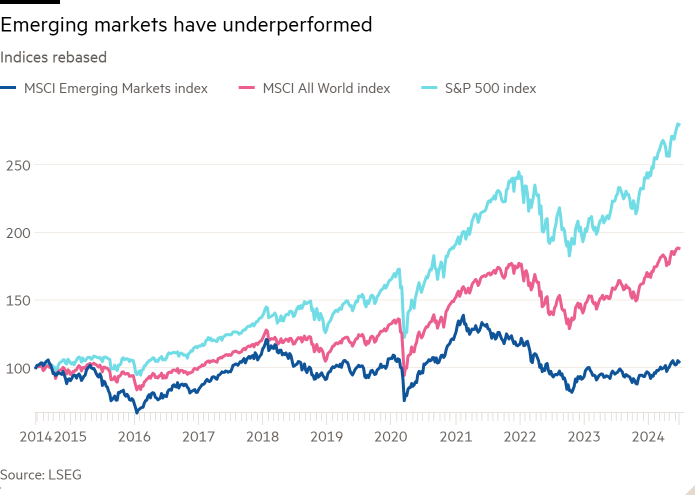

“Family offices have largely fallen out of love with emerging markets, due to the underperformance of EM stocks – led by Chinese stocks – since 2021,” explained Edmund Shing, global chief investment officer at BNP Paribas Wealth Management, shortly after it appeared in the opening panel. of the event in Monte Carlo.

The good performance of US large-cap stocks also contributed to portfolio managers changing their allocations, as did increased geopolitical risk around China and foreign exchange volatility in countries such as Turkey.

At the same time, index fund weightings underwent a similar rebalancing. Their exposure to the developing world fell due to the underperformance of its markets, while the strong performance of US stocks has prompted increased exposure to North American themes, such as the so-called “Magnificent Seven” technology companies “.

It’s a shift that partly reflects some asset managers’ view of a world divided into two blocs: one democratic and investable, the other authoritarian and opaque.

“Emerging markets are more difficult to analyze and understand, as their drivers are mainly geopolitical, FX-oriented and macro,” Shing noted at the Fund Forum event, with investment houses that prefer to focus on more transparent US or European stocks.

“The US is a large very liquid single-currency market,” he noted, “whereas EM is a collection of markets with lower liquidity, country-specific triggers and a basket of currencies to boot.”

This sense of change is supported by the annual Global Asset Tracker (GAT) survey of chief investment officers, conducted by Professional Wealth Management, a publication of the FT. In 2023, 78 percent of them rated global EMs as an “attractive” or “most attractive” asset class. In 2024, this percentage had dropped to 38 percent. US stocks are currently the main regional topic. The CIOs participating in the latest survey represent 54 private banks and manage total client assets exceeding $22 trillion.

Interest in this once ubiquitous asset class has similarly waned in the family offices that manage money for wealthy dynasties. Again, the reason is the “massive underperformance” of EMs over the past decade versus developed markets, says Didier Duret, Geneva-based head of investments at Omega Wealth Management, which oversees the portfolios of wealthy European and Eastern households. Medium. “EMs have essentially been victims of the deglobalization of investment flows,” he argues.

Risk factors – political, China’s fortunes, market risk and the risk of underperformance – have increased simultaneously, according to Duret.

Global Professional Wealth Management Asset Tracker

78%

Percentage of chief investment officers rate emerging markets as an “attractive” asset class in 2023

38%

Percentage of chief investment officers rate emerging markets as an “attractive” asset class in 2024

He recalls the “golden days,” when veteran investor Mark Mobius, who once managed roughly $50 billion in EM assets for Franklin Templeton, crisscrossed Asia “kicking the tires” on booming factories and heading to the Fund Forum for share knowledge with his disciples.

The orthodoxy of that era hinged on the theme of ‘Bric’ investment – supporting the growing economies of Brazil, Russia, India and China – which was popularized by former Goldman Sachs economist Jim O’Neill, who later became a minister of the UK government.

“Gone are the golden days of the BRICs, where allocations were promoted as strategic,” says Duret. “The current reality of allocation in family offices is pragmatic – more tactical, selective and based on the proven merits of companies.”

However, there are some private banks and investment firms that find exceptions to the arguments for selling EM. BNP Paribas favors investments in South Korea and Turkey for offering “a combination of value and fundamental catalysts”. The French bank also likes EM sovereign bonds for their high yields and “good fundamental outlook”, which compare favorably with US and European sovereign and corporate bonds.

Some family offices, meanwhile, are focusing on “specific areas that have a place in the AI sun,” according to Omega’s Duret — which includes companies in Taiwan and Malaysia. They also like companies in India and Vietnam that are benefiting from reorganizing their supply chains.

For some of these investors, India is the “bright spot” of EM. “India increasingly looks like the next big thing in geopolitics, as it naturally benefits from the West’s ‘hand-off’ approach to China,” says César Pérez Ruiz, head of investments at Pictet Wealth Management in Geneva. Southeast Asian countries are also likely to receive manufacturing displaced from China as a result of the West’s geopolitical rivalry with Beijing.

Shing supported India at the Fund Forum event, although he was careful not to write off Beijing. “High net worth investors still buy the story of Modi’s transformation of India and the potential to overtake China economically,” he said. But he added: “Chinese stocks, although still volatile, could be a good long-term investment for patient investors at this point.”

However, whether portfolio managers and clients behave rationally when underweight emerging markets is a moot point.

EM portfolio allocations, at 10 to 15 percent on average, are lower than a GDP-weighted average would recommend, according to Chris Richmond, head of manager research at asset management consultancy WTW.

He puts this down to the fact that holding shares in US exporters gives most investors a built-in exposure to EM dynamics. “If you look at global equity gains in the US market, you get a huge amount of exposure to emerging markets,” he says – and that creates less incentive “for a more strategic, long-term weighting.”

But he doesn’t think that’s the best approach to investing in EM. “We believe we can find a manager who does a really good job in emerging markets and, through active and engaged management, is investing in some world-class companies that have dominant positions in their sector,” he explains. “They exist and this is a great investment opportunity. It’s just a lot harder.”

#Emerging #markets #losing #appeal #family #offices

Image Source : www.ft.com